The organization or structuring of the sales force is the cornerstone of the business operations. If the foundation is weak, the entire sales process will suffer. How the sales team is structured affects the business’s long-term success.

There are several models for structuring the sales force. The challenge is to find the one that best meets the needs of the customers and the business and promotes growth.

What is the importance of having a well-structured sales force?

Organizing the sales force consists in defining the structure or specialization of the teams that give more advantages to the company and its customers. Ensuring a correct allocation of salespeople’s time to customers and a total alignment with the business priorities is essential.

The main benefits of having a well-structured sales force are:

Increase in productivity

A correct structuring of the team and a good allocation of salespeople to customers allows for more productive teams;

Increase in sales

Properly structured teams can do their job more effectively and focus on higher value-added activities, which results in increased sales and market share;

Improved customer satisfaction

A well-organized sales force helps the company to establish a closer and longer-lasting relationship with customers, and this can lead to an increase in customer loyalty;

Improved brand image

A perfectly organized, trained, and professional sales force can help improve the brand image in the minds of customers;

Identification of market opportunities

A well-structured sales force can also help salespeople to identify market opportunities more effectively;

Cost reduction

Having the appropriate resources for the targeted customers allows the company to decrease sales force costs.

In short, a well-structured sales force can help a company increase sales, improve customer relationships, identify more market opportunities, and decrease costs.

Sales Force Structuring Models

There are different types of specialization that sales teams can have, depending on the type of product or service they are selling and the specific market and customer needs.

Some examples of sales force specialization or structuring models:

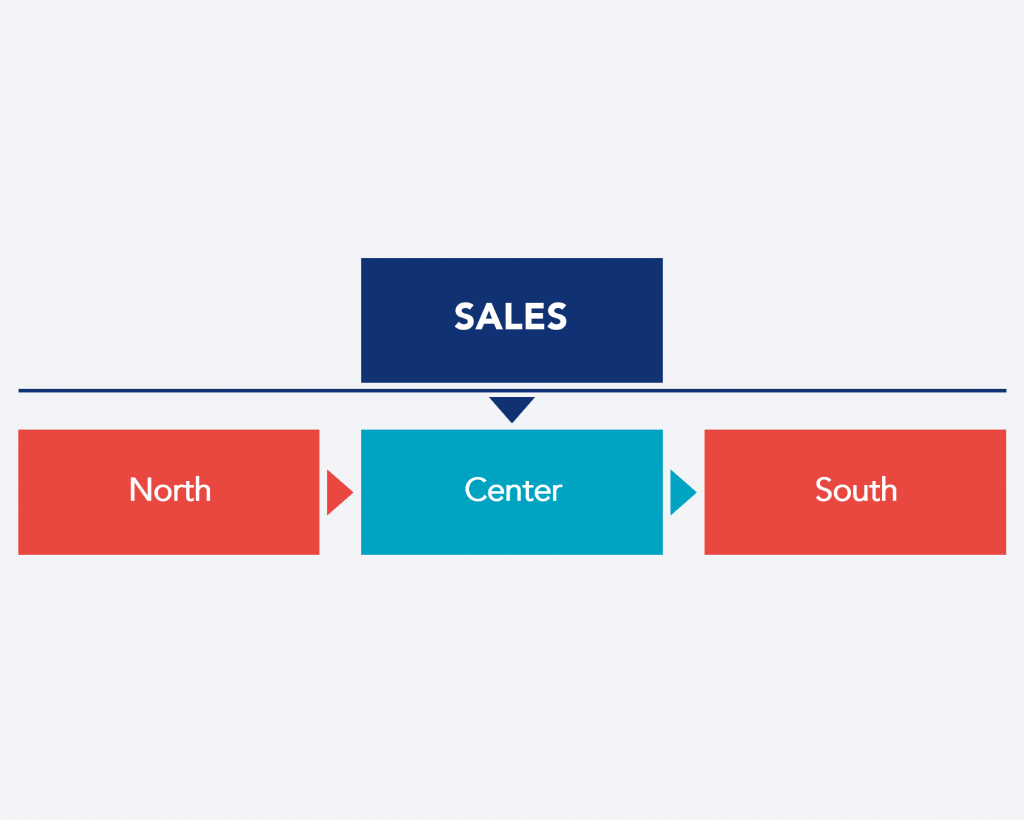

GEOGRAPHIC

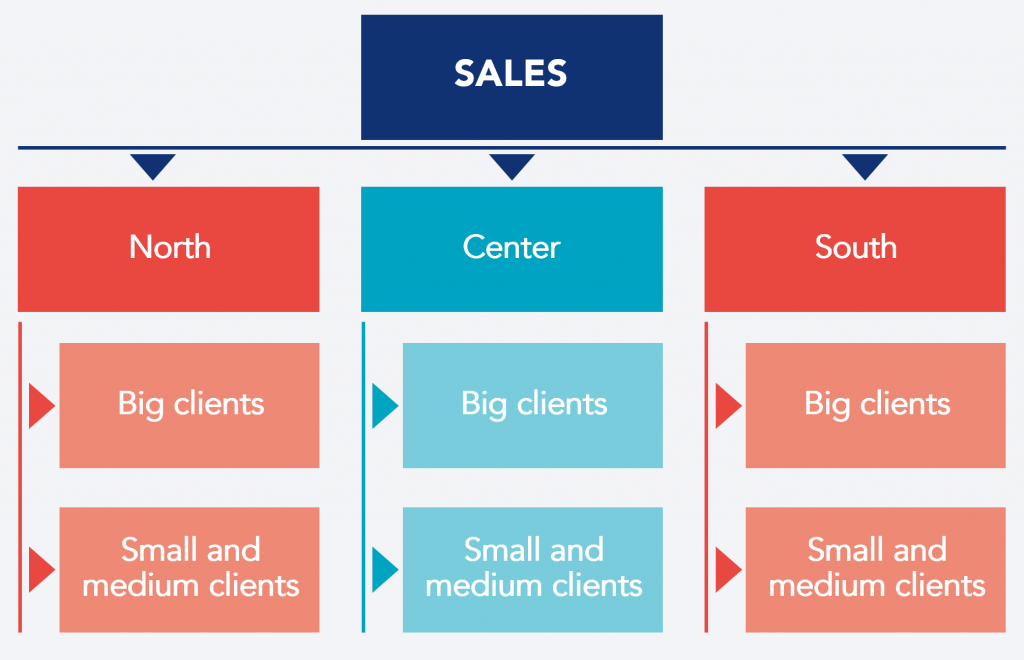

In this model, a single salesperson or a selected sales team serves all business opportunities or customers in a given geographical area. This type of structure promotes the building of relationships with customers and minimizes travel. On the other hand, it forces the salesperson to be a generalist since they will be selling the whole range, mastering a greater diversity of products, resulting in a lower specialization level. This may have an impact on efficiency by reducing the degree of focus.

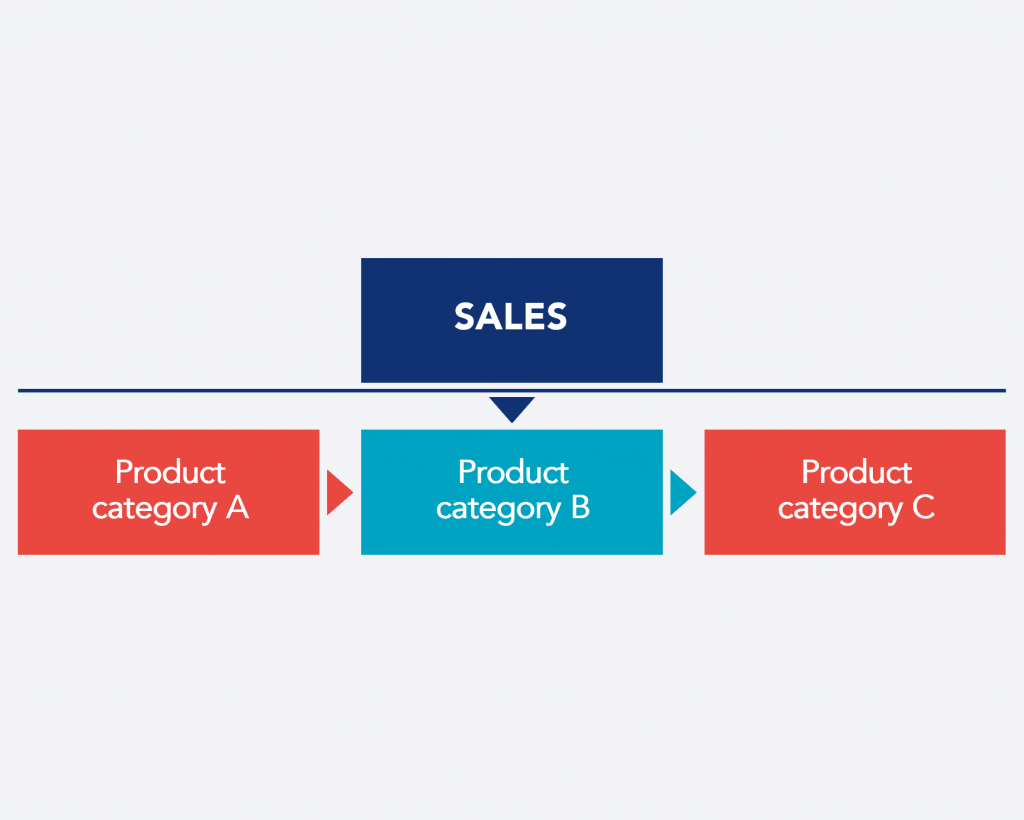

PER PRODUCT

In this type of specialization, salespeople selected to sell a particular product become experts in the category. The most promising opportunities are targeted to those most experienced in that product. This strategy is for when the product range is complex and non-related. Due to the high degree of specialization, there may also be an advantage in having salespeople involved in product development. On the one hand, this can be a decisive factor in increasing product sales. On the other hand, one must consider the costs, since the salesperson will travel more. It can also have the disadvantage that a customer has to contact several salespeople in the company if they are interested in more than one product category.

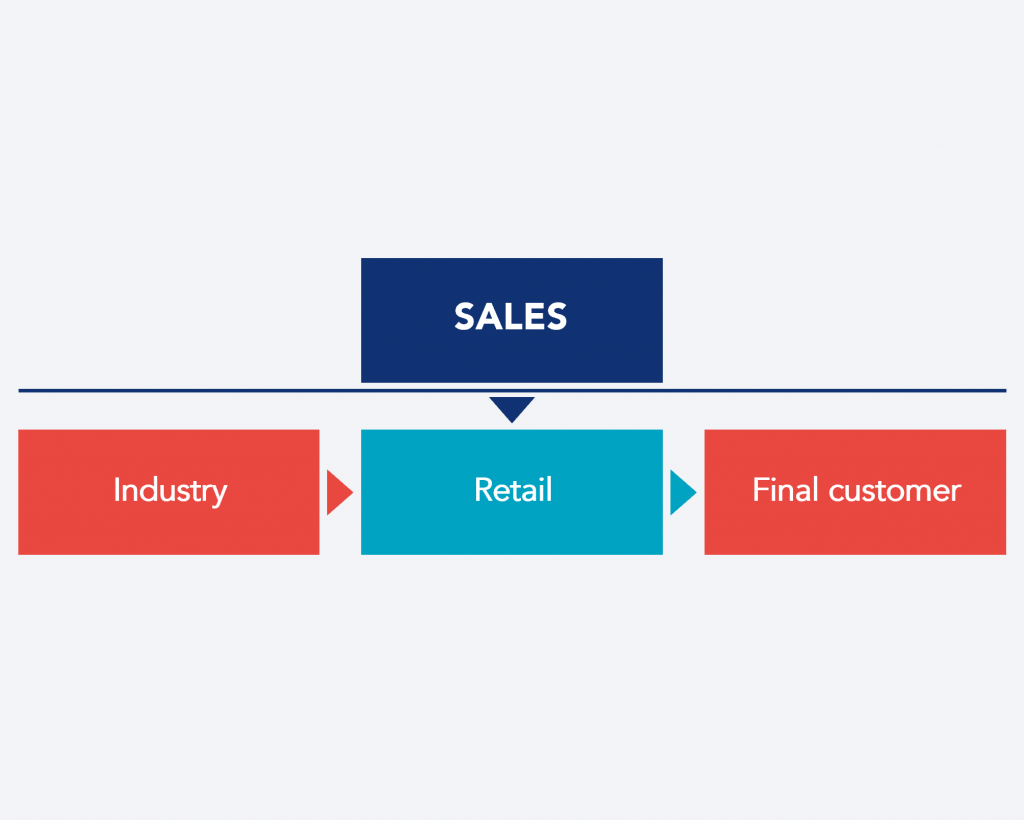

PER INDUSTRY

This model assigns specific customer types to salespeople that meet that target audience’s needs. Use the industry or sector structure if companies operate in different market segments. Each sales force specializes in a particular market, which gives them a greater understanding of the customer’s needs and pain points. It has the disadvantage of increasing costs if the customers’ network comprises a wide geographical area.

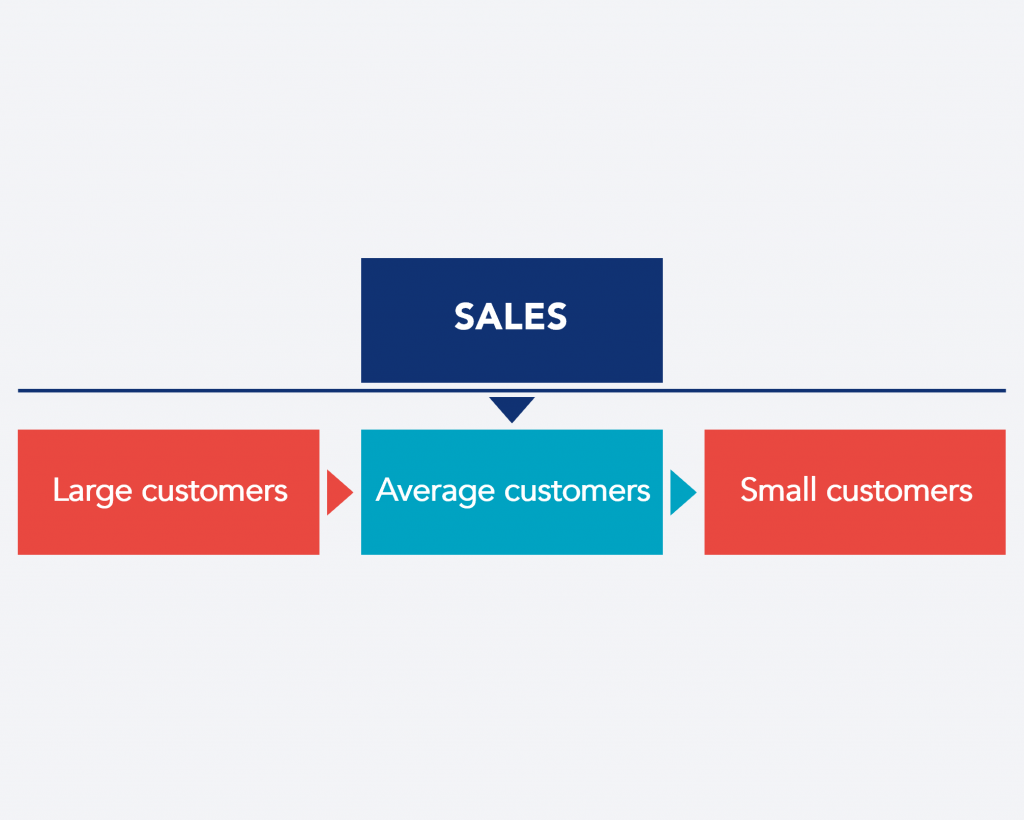

BY CUSTOMER DIMENSION

Organizing sales by account dimension is another possible structure. The skills a salesperson needs to sell to an SME differ from those of selling to a large corporate account. These customers have different goals, different buying processes, and also very different budgets. The key-account managers, usually more experienced professionals, manage larger customers. For this model to succeed, it is essential to ensure that small and medium-sized customers receive good follow-ups on the buying process.

FUNCTIONALLY

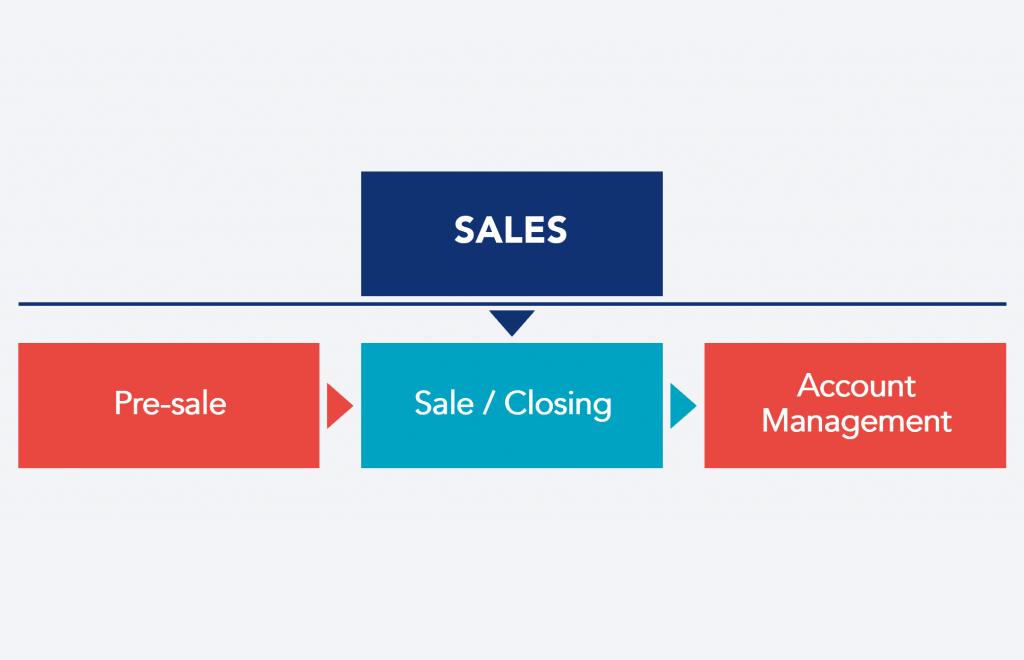

Most sales processes require multiple activities. Thus, the operation is often more efficient when salespeople specialize in completing specific core tasks. This type of model is most suitable for complex sales. The disadvantage is that the customer must be in contact with multiple people, sometimes resulting in inefficiencies at the checkpoints if the processes are not standardized.

MIX

We can also have a mixed organization, that is, one that is a combination of the solutions presented above. An organization can, for example, adopt a geography-based model for less specialized products and a product-based model for products that require a more technical approach. Another example is to have a geography-based model. Still, each geography has a division by size to manage better strategic customers that need a closer and more personalized relationship.

These are just some of the main types of specialization. To summarize, the structure of the sales force depends on the specific needs of the company and its customers and on the type of product or service the organization sells.

How to select the best sales force structuring model?

One must perform a background analysis to select the best sales force structuring or specialization model. This requires answering a set of key questions on several topics:

- Market and customers: What is the potential market? Which segments do we want to conquer? Where are they located? What is their size? What are the priorities?

- Buying process: What is the buying process like? Is it long? Is it complex?

- Product portfolio: Is the product portfolio varied? Does it require specialization in selling?

- Available resources: Which sales channels will we use? What is the budget? How many salespeople does the sales force have?

- Customer experience: What are the satisfaction rates? What are the pain points? How can we improve the buying experience?

After clearly answering these questions, it is necessary to evaluate the possible types of specialization (geographical, product, market, functionality, mix, etc.) and identify the advantages and disadvantages of each type of solution. Based on this analysis, select the best type of specialization for the business.

The process to Structure a Top Performing Sales Team

Assigning salespeople’s time based on the customers’ buying potential is essential to maximize the efficiency of the sales force and increase the company’s revenue. By focusing sales efforts on customers with the highest buying potential, the team can generate more sales in less time, increasing productivity and reducing the cost of customer acquisition.

After selecting the specialization type, it is necessary to define how to allocate the team’s capacity to customers and define a strategy per customer typology. Generally, the process consists of three steps:

- Assess the customer’s potential

- Categorize customers by potential and other criteria

- Define the sales strategy

Assess the customer’s potential

The first step in defining a strategy for each customer is to classify them by buying potential. The buying potential refers to the number of products or services they can buy in a given period. This includes financial capability and interest or need for the product or service. The sales effort should be equal to this potential.

The assessment of the customer’s buying potential comprises several factors, such as:

- Turnover value;

- Nº of collaborators;

- No. of factories/shops/warehouses;

- Square meters of facilities;

- Others.

Tailor the indicator selection to the type of business and design and validate it based on existing data analysis. It is important not to confuse the concept of customer potential with the amount the customer currently buys since current consumption may be far below the customer’s buying potential.

Categorize customers by potential and other criteria

Once the indicator to use is selected, it is necessary to define the ranges for each group. For example, if the criterion is the number of collaborators at the customer, the division could be as follow:

- A-Customers: More than 1,000 collaborators

- B-Customers: Between 200 and 1,000 collaborators

- C-Customers: Less than 200 collaborators

The next step is to find the formula for converting the selected indicator into buying potential, i.e., into Euros. For example, the purchase potential of a customer in a year is estimated by multiplying the number of collaborators by 1000€. Thus, estimating how much the company can grow with each customer is possible. It is worth noting that the calculation of potential is always an estimate with some margin of error, but over time, one must improve the formula.

If the sales strategy depends on factors other than buying potential, it is necessary to identify them. Some examples of such factors to consider are:

- Geographic location;

- Activity sector;

- Digital channel usage level;

- Customers of a specific product segment.

Definition of the sales strategy

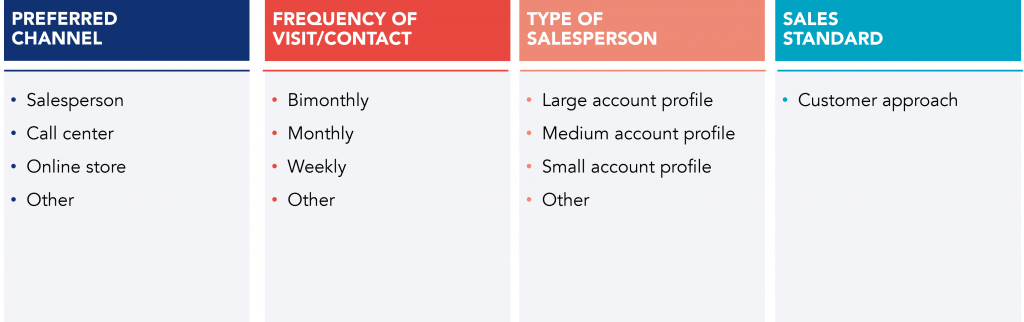

With the categorization of customers done, defining the strategy for each type is necessary. For example, preferred channel, frequency of visit or contact, type of salesperson, and sales standard.

Top-performing Sales Force

After properly structuring the sales force and optimizing the allocation of resources and the sales approach, it is necessary to ensure that these teams have:

- A clearly defined strategy and goals;

- Good team management standards, such as regular meetings to follow up on the buying funnel and KPIs and to share best practices;

- Leaders who work as coaches and continuously develop the skills of salespeople;

- Effective sales processes based on Value Selling and with good insights resulting from analytical research of the customers and the market, with a deep understanding of the customer’s needs and problems;

- An understanding of the customer’s needs and problems; Alignment with the other teams in the organization, such as marketing and customer service, ensuring an excellent omnichannel experience;

- A process for optimizing the customer’s buying experience, built on the continuous collection of the voice of the customer;

- Technology and analytical capabilities enable correct data sharing and insight generation.

This is the only way to have a top-performing sales force that consistently achieves its sales targets and exceeds revenue and customer satisfaction expectations, promoting sustained business growth.

See more on Sales & Marketing

Find out more about improving this business area