Pursuing sustainable development has driven various international legislative initiatives, including the European Union’s Green Taxonomy. It aims to direct investments and economic activities toward initiatives promoting environmental preservation, carbon emission reduction, and efficient natural resource use. In this article, we explore the fundamentals of the Green Taxonomy, its importance in the transition to a low-carbon economy, and the future of this instrument in building a more sustainable world.

What is the Green Taxonomy?

The European Union’s Green Taxonomy is a classification system designed to identify environmentally sustainable economic activities. This system provides clear and detailed criteria to establish whether an investment can be considered green, helping to direct capital toward projects that promote sustainability.

Objectives and importance of the Green Taxonomy

The European Union (EU) Taxonomy is an effort to regulate non-financial information disclosure requirements. Instituted by EU Regulation 2020/852, the Green Taxonomy has several objectives to align economic activities with global environmental goals. Its main objectives are:

- Helping to increase investments in projects that contribute to the EU’s environmental goals.

- Protecting investors against “greenwashing”.

- Assisting companies in planning and financing their green transition.

- Standardizing what investors classify as green, reducing information asymmetry.

- Directing investments to meet the EU’s climate and environmental ambitions

The importance of the Green Taxonomy lies in its ability to provide a clear and consistent framework that helps investors, companies, and governments align their activities with global environmental objectives.

Economic sectors included in the taxonomy

The Green Taxonomy will impact various economic sectors. Financial sector entities and large public-interest companies with more than 500 employees must disclose how and to what extent their activities contribute to environmental objectives. The European Commission has established criteria for economic activities relevant to promoting climate neutrality and adaptation to climate change. The activities identified were distributed across various sectors, including:

- Forestry

- Environmental protection and restoration activities

- Industrial production

- Energy

- Water supply, sewage, waste management, and remediation

- Transportation

- Construction and real estate activities

- Information and communication

- Professional, scientific, and technical activities

- Gas and nuclear energy.

The fact that some or all of a company’s activities are not included in the list does not mean they are unsustainable. It may simply mean that criteria have not yet been developed for those activities and, therefore, are not yet covered by the EU Taxonomy.

Conditions for activities to comply with the EU Taxonomy

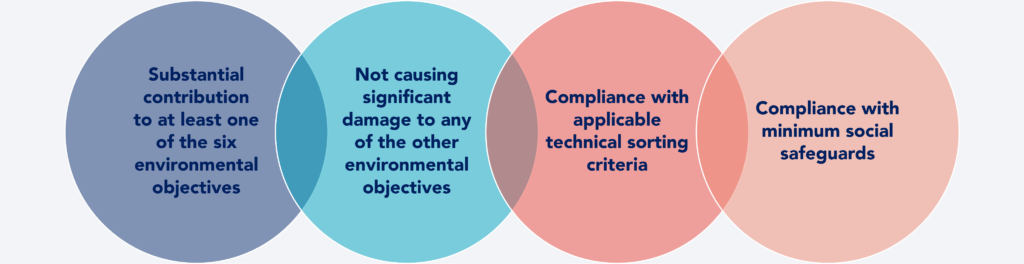

The Green Taxonomy is based on specific criteria for identifying environmentally sustainable economic activities. These criteria are essential to ensure that investments align with sustainability goals and promote responsible and beneficial practices for the environment and society.

The criteria guide investors and help companies and governments align their activities and policies with global sustainability goals. Below is an overview of the principles underlying the Green Taxonomy:

- Substantial contribution to environmental objectives: the activity must significantly contribute to at least one of the six environmental objectives defined by the taxonomy:

– Climate change mitigation.

– Climate change adaptation.

– Sustainable use and protection of water and marine resources.

– Transition to a circular economy.

– Contamination prevention and control.

– Protection and restoration of biodiversity and ecosystems.

- Do no significant harm: The activity must not significantly harm any other environmental objectives. This principle ensures that negative impacts in one area do not offset positive contributions in another.

- Compliance with technical criteria: The activity must meet specific technical performance criteria (Technical Screening Criteria) for each environmental objective. These criteria provide actual and measurable standards.

- Minimum social safeguards: The activity must comply with minimum social safeguards, such as human and labor rights, and be aligned with international principles and guidelines, including those from the UN and OECD.

Fig. 1 – Conditions for activities to comply with the EU taxonomy

Company compliance with the Green Taxonomy

Implementing compliance with the Green Taxonomy involves a set of steps and challenges that must be managed to ensure its success. Governments and institutions play a crucial role in this process, providing the necessary support and establishing guidelines for adopting sustainable practices.

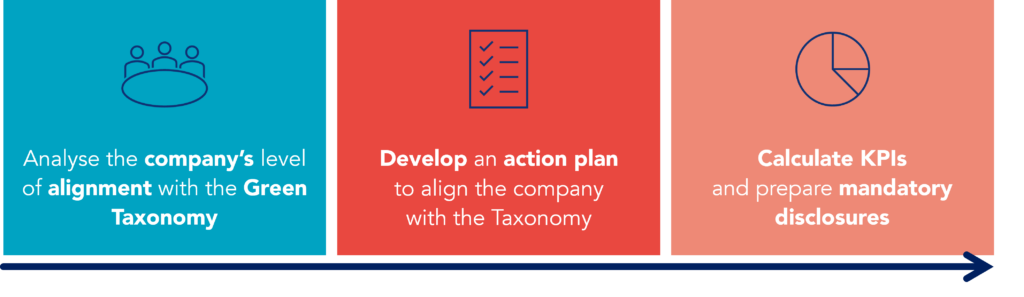

Steps for companies to align with the Green Taxonomy

Aligning a company’s activities with the European Union’s Green Taxonomy requires a structured process. The main steps necessary to ensure compliance with the regulation’s requirements are outlined below:

- Assessing the eligibility and alignment of the company with the Green Taxonomy

- Eligibility: Evaluate the organization’s activities that are eligible for inclusion in the taxonomy. This involves checking if the activities are listed in the taxonomy’s sustainability criteria.

- Alignment: Determine the level of alignment of eligible activities with the technical criteria established by the taxonomy. This includes assessing the substantial contribution to environmental objectives and compliance with performance standards.

- Do No Significant Harm (DNSH): Ensure that the activities do not significantly harm any of the other environmental objectives. This step requires a detailed analysis of potential impacts and, if necessary, implementing mitigating measures.

- Minimum Safeguards: Verify compliance with minimum social safeguards, such as human and labor rights, in line with UN and OECD principles.

2. Developing an action plan to align the company with the taxonomy

- Alignment Strategy: Develop a comprehensive strategy to align the organization’s activities and operations with the taxonomy criteria. This may involve restructuring processes, adopting new technologies, and implementing sustainable practices.

- Implementation: Execute the plan, ensuring that all parts of the organization know the requirements and commitments. This can include training, operational changes, and supply chain modifications.

- Monitoring and Review: Establish monitoring and follow-up mechanisms to ensure the organization maintains compliance with the taxonomy criteria. Improvements should be implemented whenever necessary.

3. Calculating KPIs and preparing mandatory disclosures

- KPIs Identification: Define and work out the relevant Key Performance Indicators (KPIs) measuring the organization’s performance against the taxonomy criteria.

- Disclosures Preparation: Prepare mandatory disclosures detailing how the organization’s activities meet the taxonomy criteria.

Fig. 2 – Process for compliance with the green taxonomy

Following these steps, an organization can meet the European Union’s Green Taxonomy’s regulatory requirements, strengthen its sustainability commitment, and improve its market position.

Implementation Challenges

Implementing the Green Taxonomy may present several challenges. Among the main obstacles are:

- Regulatory uncertainties: The complexity of environmental and financial policies can create uncertainties, making it difficult to plan and implement green projects and comply with the taxonomy.

- Cost and complexity: Adjusting operations to meet the Green Taxonomy requirements can be costly and technically challenging, especially for small and medium-sized enterprises that may lack the necessary resources.

- Transparency and disclosure: Companies need to develop robust systems to measure and report their environmental performance transparently and consistently, which can be a barrier for many.

Overcoming these obstacles is essential for the Green Taxonomy to realize its potential in driving sustainable and responsible economic development.

The role of governments and institutions

Governments and institutions play a crucial role in facilitating the implementation of the Green Taxonomy through various strategic actions:

- Develop clear policies and regulations: Governments can create clear and consistent regulations that guide companies and investors, helping reduce uncertainties and promote sustainable practices.

- Financial incentives: Tax incentives, subsidies, and other financial support can encourage companies to adopt green practices. This can include tax cuts and preferential financing for sustainable projects.

- Promote public-private partnerships: Fostering partnerships between the public and private sectors can accelerate the implementation of sustainable projects by combining resources and expertise from both spheres.

- Education and awareness: Promoting educational and awareness campaigns for the public and companies about sustainability’s importance and how the Green Taxonomy can benefit society and the environment.

Addressing implementation challenges and strengthening the role of governments and institutions can make significant progress in transitioning to a greener and more sustainable economy.

Future of the Green Taxonomy

The future of the Green Taxonomy is set to be dynamic and ever-evolving, with several trends and developments expected in the coming years. This future will be shaped by technological advances, changes in government policies, and the need to adapt to climate change.

Global integration and standards harmonization

One of the main trends will be the pursuit of greater global harmonization and integration of the Green Taxonomy criteria. International organizations and governments must work together to create consistent standards that can be applied across different jurisdictions. This will facilitate the flow of capital to sustainable projects and reduce barriers for companies operating in multiple markets.

Scope expansion

Currently, the Green Taxonomy focuses primarily on the energy, transportation, and construction sectors. In the future, its scope is expected to expand to include a broader range of economic activities, allowing for a holistic and comprehensive approach to sustainability.

Coverage expansion

Implementing the Corporate Sustainability Reporting Directive (CSRD) will expand mandatory compliance with the Green Taxonomy from 11,000 to around 50,000 organizations.

Strengthening government policies and incentives

Governments worldwide will likely increase their efforts to support the Green Taxonomy through robust policies and financial incentives. This may include creating new regulations, offering funding and tax incentives, and supporting research and development initiatives. The government’s role will be essential in creating a favorable environment for widespread sustainable practices.

Greater involvement of the financial sector

The financial sector will be a crucial catalyst for implementing the Green Taxonomy. Banks, investment funds, and other financial institutions are expected to increase their investments in sustainable projects significantly. As a result, green financial products, such as green bonds and sustainable loans, will become more common and accessible.

The future of the Green Taxonomy is promising and full of opportunities to promote a more sustainable and resilient global economy. If governments, the private sector, and civil society all collaborate together, significant progress can be made in combating climate change and protecting the environment.

Still have questions about the Green Taxonomy?

What is Greenwashing?

Greenwashing is a term used to describe a practice where companies or organizations promote a misleading public image of environmental responsibility. This is done by publicizing information, actions, or initiatives that appear more eco-friendly and more sustainable than they are. The goal is to attract environmentally conscious consumers, improve the company’s reputation, or avoid criticism without genuinely implementing sustainable practices.

How does the Green Taxonomy relate to other environmental regulations and standards?

The Green Taxonomy is related to various environmental regulations, directives, and standards. On a multilateral level, it aligns with the UN’s Sustainable Development Goals (SDGs), directing investments toward activities supporting objectives like climate action, clean energy, and sustainable communities. It also complements the Paris Agreement by directly supporting goals to reduce greenhouse gas emissions and limit global warming.

Within the European Union, the Green Taxonomy is part of the Action Plan on Financing Sustainable Growth, integrating with other regulations such as the Sustainable Finance Disclosure Regulation (SFDR), which requires disclosures on incorporating ESG factors in investment decisions. It also aligns with the Climate Benchmark Regulation, defining standards for climate benchmarks, and the Corporate Sustainability Reporting Directive (CSRD), which will expand sustainability reporting requirements to more companies.

Additionally, the Green Taxonomy complements international reporting standards like the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB) standards, enhancing transparency and consistency in sustainability reporting and facilitating comparison and assessment by investors and other stakeholders.

What company activities are eligible?

The eligibility of activities under the Green Taxonomy depends on specific criteria established to define if an economic activity is sustainable. Here are the main types of activities and general criteria:

- Climate mitigation activities:

– Renewable energy (solar, wind, hydro)

– Energy efficiency (building renovations, efficient technologies)

– Sustainable transport (electric vehicles, public transportation)

– Sustainable agriculture and forestry practices

- Climate adaptation activities:

– Climate-resistant infrastructure

– Sustainable water management

– Disaster risk reduction

- Biodiversity and ecosystem protection and restoration:

– Biodiversity conservation

– Habitat restoration

- Circular economy:

– Recycling and waste management;

– Product design for reuse and repair.

To be eligible, an activity must:

- Contribute significantly to one or more environmental objectives.

- Do no significant harm to other environmental objectives.

- Meet specific technical performance criteria.

- Respect minimum social safeguards.

How will the Green Taxonomy affect access to financing and investment?

The Green Taxonomy can affect access to financing and investment in several ways:

- Access to green capital: Adhering to the Green Taxonomy can facilitate access to green funds and sustainable financial instruments (e.g., green bonds and green loans). Institutional investors, such as pension and sovereign wealth funds, increasingly want to associate their portfolios with sustainable activities.

- Reduced cost of capital: Companies complying with the Green Taxonomy may benefit from more favorable financing conditions, such as lower interest rates and better risk assessment by investors, reducing the cost of capital.

- Investor attractiveness: Compliance with the Green Taxonomy can enhance a company’s reputation and attractiveness to ESG-focused investors. Investors are increasingly focused on avoiding assets that may be subject to climate transition risks.

- Incentives and subsidies: Governments and financial institutions may offer specific incentives and subsidies for activities that meet the Green Taxonomy criteria and financial and fiscal support programs to transition to a sustainable economy.

Adopting the Green Taxonomy can bring various financial benefits while supporting the transition to a more sustainable economy.

For more information, please visit this link.

See more on Sustainability

Find out more about improving this business area