For all companies operating in a global market, which results from an increasingly complex mix of local markets, competitiveness, and growth can only be driven by a full grasp of the business environment in which they operate. All opportunities and threats involve a series of organizations, industries, and market trends and a complex series of interdependencies between them. Although this operating environment is complex and multidimensional, it can be analyzed in a structured way.

The amount of available market information has increased over the past few decades. Many decision-makers experience real “information paralysis,” which happens when the amount of information makes it difficult to digest and distinguish what is relevant for decision-making.

Managing business information means finding relevant data and processing it into insights to help make growth-oriented decisions. There needs to be an area of the organization responsible for collecting and processing relevant information for decision-making. That area is Market Intelligence (MI).

What is Market Intelligence?

Market Intelligence collects information about market players and strategically relevant topics and turns it into insights that support decision-making.

Market Intelligence is part of strategic planning, business development, and marketing.

Some questions that MI can help answer:

- Where should the company devote more resources?

- Which markets should it focus on in the future?

- Are there any buying patterns from our customers?

- What products can be marketed to existing customers?

- In which demographic segments can the company launch new and existing products?

What are the Market Intelligence goals?

Market Intelligence is critical for the business for two reasons:

- The operating environment of organizations is becoming increasingly complex and dynamic, and accurate business information is necessary at all levels of the organization;

- Decision makers face the challenge of “information disconnection”, which is not caused by a lack of information, but by the lack of time to digest it and to distinguish and process what is truly relevant for decision-making purposes.

The main goals of Market Intelligence are to provide information to the business that allows:

- To anticipate the competitors’ reactions or changes in the surroundings;

- To identify new competitors or possible partners;

- To monitor the supply of competing products, their commercial policies, and the respective regulations;

- To learn the characteristics of new markets, including the mistakes and successes of other players, to improve management practices.

The Benefits of having a Market Intelligence Program

The results of a MI program must be demonstrated by the organization’s competitiveness and success in its operational environment.

The following benefits can be highlighted:

Improvement of the decision process (impact on decision-making):

- Better decisions: Support decisions by research-based insights to capitalize on opportunities and eliminate risks;

- Faster decisions: Avoid surprises and have the constant ability to make informed decisions even under time pressure;

Time and cost savings (organizational efficiency):

- Time-Saving: Save time for decision-makers from searching for accurate information to make decisions based on it;

- Cost savings: Avoid inefficiencies in acquiring and processing business information;

Continuous learning (shared understanding and idea generation):

- Organizational learning: Facilitate the shared understanding and creation of insights through continuous exposure of employees to constantly updated information;

Market Intelligence System

Organizations wishing to create a structured Market Intelligence system should focus on developing six elements critical to the successful development of MI.

1. Scope of Market Intelligence

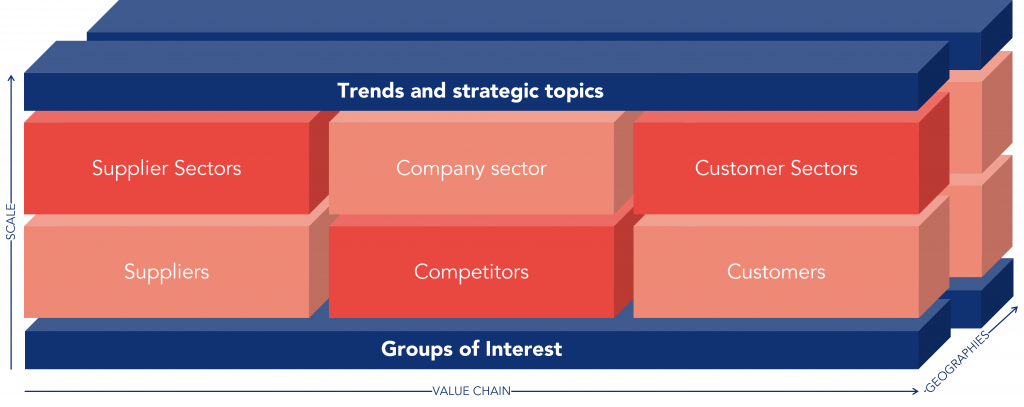

The scope of the MI refers to defining the very purpose of the program, the user groups, the timing of activities, and the specific topics on which the user groups will need information regularly. Topics include, for example, customers, competitors, suppliers, trends, and geographic areas of the market.

Questions to answer:

- What is the purpose of the program? What is the reason for its existence and the key drivers of the entire intelligence program? Definition of purpose, mission, and vision.

- What will the user groups be? What are the corporate areas and target user groups should the MI program serve?

- How broad will the scope be? What topics will the target groups need information on, and how will they be prioritized?

- What will be the time horizon? What will be the time horizon and the future orientation of the MI program?

It is necessary to define what the scope of the MI will be in each organization.

2. Market Intelligence Process

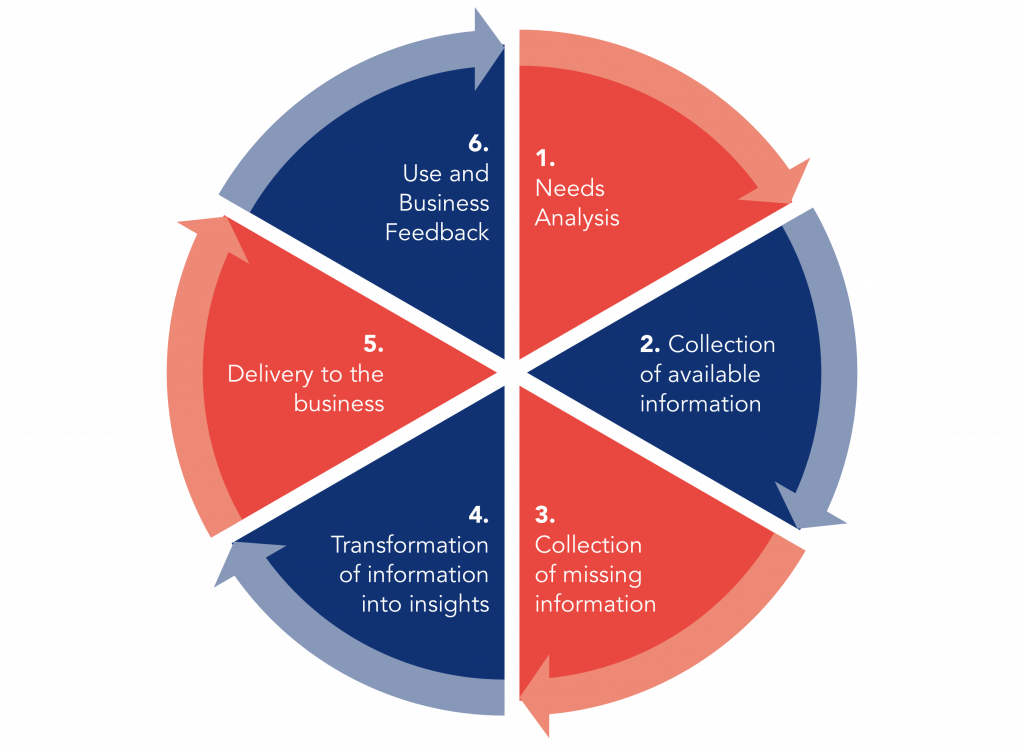

The Market Intelligence process refers to collecting, analyzing, and sharing information with user groups.

The MI process should always be linked to business processes: strategic planning, innovation, product management, marketing and sales, and supply chain management.

The process of Market Intelligence is cyclical. It starts with the assessment of needs, then the analysis of available information and collection of missing data, followed by its analysis and transformation into insights, delivery to the business, and finally, the business uses the available information and gives feedback so that it can continuously improve.

Although the cycle is generally this, there are two types of approaches to doing this, depending on the goals defined in the needs analysis:

- Quick response surveys where speed is essential, so there is little time to perform the analyses and produce comprehensive reports.

- Strategic analyses that must be thorough and produce well-structured, detailed reports. In this case, the quality and level of detail are more important than speed.

Market Intelligence lives off the available information. For the information-gathering stage, there are several types of information sources:

- Market studies on potential buyers: Determine the demand for the product/service;

- Market studies on distributors, agents, and other intermediaries: Find out how best to place products and services on the market and what demand exists for the product/service;

- Studies on the competition: Find out the process of entry and performance of other successful companies in the market and assess the receptiveness of the market to new players;

- Databases (reports, experts, journalists, institutes, agencies, and others): Access databases that provide a quick and concise overview of the market and contacts of key players.

3. Market Intelligence Deliverables

Market Intelligence deliverables are the practical output of the MI process.

The results can be tangible content products, such as analysis reports, market maps, profiles, and monitoring of market signals, or intangible ones such as interactive workshops. They may also include software designed to enable self-service use of the MI.

Regarding the time period, deliverables may be continuous services in which information must always be available and updated or services performed for a specific project within a limited time.

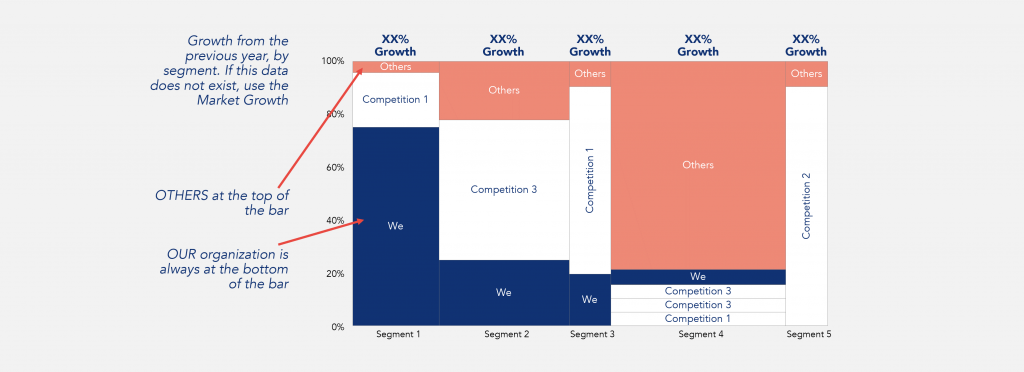

Market Maps

Market maps are one of the key deliverables or outputs of MI. A market map can be used to break down a market by combining data from multiple charts into a single, more powerful two-dimensional chart.

The term “market map” is often used to refer to Mekko Maps.

These maps are one of the best charts to define a company’s market strategy, because it provides a visual representation of the overall market and helps drive discussions about growth opportunities or acquisitions.

The Mekko map allows one to break down a measure, such as revenue or costs, into its components to understand the representative size of each component.

Market maps help answer several questions, for example:

- What are the biggest market segments?

- How does competition vary by region?

- Where are the opportunities for growth?

To be able to build a market map, it is necessary to have access to fairly complete market information. The steps for creating market maps are:

- Know the total size of the market;

- Divide the market in segments (primary segmentation);

- Dimension each segment (width of the bars);

- Estimate the market share of each player in each segment (height of the bars);

- Estimate the annual growth rate of each segment (use arrows).

Some best practices in building these maps are using data from a single period, grouping the smaller segments into “other” series to improve the chart’s readability, and sorting the data so that the longest bars are on the left and the biggest series are at the bottom.

There is software that allows you to create these charts in Excel easily.

4. Market Intelligence Platforms

Market Intelligence platforms are dedicated MI software tools that help maintain the MI process by serving as a search database of structured and relevant information.

MI platforms help automate data processing routines and regularly deliver MI output to users. MI tools can also include models and analysis techniques.

An intelligence portal is one of the most tangible elements of an MI program. It functions as a centerpiece of the program, even though people do most of the value-added work.

An MI portal is also a great marketing vehicle for the results and the entire MI program.

Valuable features and aspects to consider when implementing an MI portal: content management capabilities, resources for data collection and entry, security, outreach possibilities (“push” from the MI team to users), and self-service access possibilities (“pull” by the MI users).

5. Market Intelligence Structure

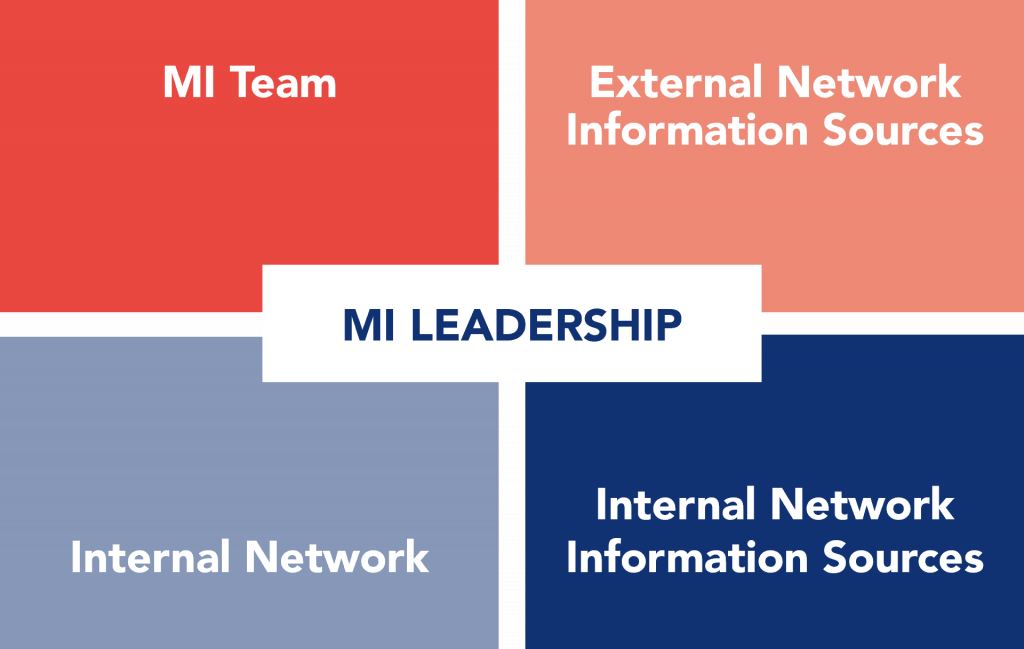

The Market Intelligence structure refers to the resources that combined make the MI process possible.

Assigning someone as the leader of the corporate MI activity is usually the starting point for building an MI structure. Still, the person needs internal and external networks to work.

The MI structure comprises five distinct elements that can assume different shapes in different companies depending on the program’s centralization level, on the one hand, and internal resources versus outsourcing, on the other.

- MI leadership: the sponsor of the activity and the person responsible for managing the MI operations;

- MI team: a centralized or local MI team serving MI users in the organization;

- Internal network: MI users and collaborators from different parts of the organization;

- Standardized external information sources: a portfolio of commonly used information sources for which there is typically also a predetermined budget;

- Internal network information sources: outsourcing partners, databases, industry consultants, research/research report providers, etc.

6. Market Intelligence Culture

The Market Intelligence culture is what keeps the entire MI program alive. Two key elements to developing a true MI culture are top management commitment and benefits demonstration.

Genuine support from top management for the activity is critical. All levels of the company must understand that MI is an activity that is part of the organization’s strategy, contributing to business growth.

On the other hand, demonstrating the real benefits of MI allows an understanding of the ROI made in these activities. These benefits must be communicated so everyone understands the MI outputs’ value.

Market Intelligence Maturity Levels

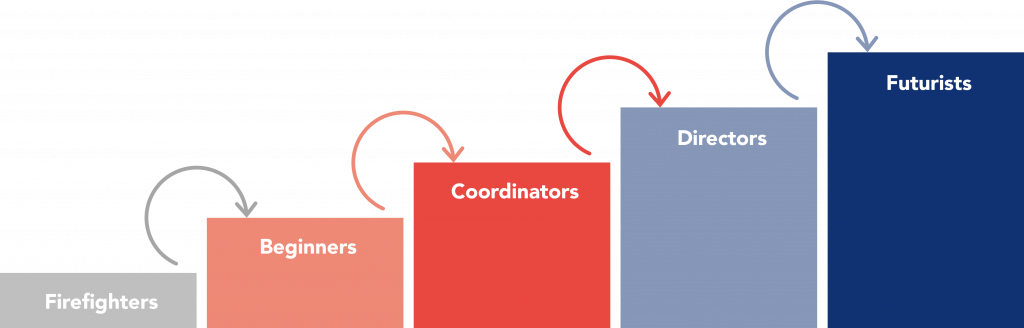

The maturity level of an organization in implementing MI is generally measured in five levels: Firefighters, Beginners, Coordinators, Directors and the highest Futurists.

1. Firefighters:

MI activities are conducted primarily on an ad hoc basis with little coordination. There are few resources for MI, and no scope or process has been defined for MI activities.

2. Beginners:

These are taking the first steps toward a structured MI program. Based on an MI needs analysis, some key elements of the organization’s business environment are being monitored, mostly still on an ad hoc basis.

3. Coordinators:

The organization has adopted a structured MI process. However, narrow in scope, the analysis has reached a reasonable level. Yet the program is only vaguely integrated with the business processes, if at all. A software tool for MI is usually implemented at this stage.

4. Directors:

The intelligence program is already at an evolved level and involves internal organization and connection with business processes. A solid external network of information sources and suppliers has also been created. The outputs of the MI process match the needs articulated by the decision-makers and generate real business impact.

5. Futurists:

MI plays a vital role in both the formulation and implementation of company strategy, enhancing the quality of work and future orientation of the entire organization. MI is an integral part of most business processes.

Conclusion

From all of the above, it is easy to conclude that information is a precious commodity. One of the most significant factors influencing a company’s ability to stay ahead of the competition is having a thorough understanding of its competitors, its industry, and the changing consumer environment in general. In other words, when information is lacking, decision-making is a shot in the dark.

Market Intelligence is responsible for ensuring that information is collected and analyzed specifically to provide that decisions are made accurately and reliably in determining new market opportunities, penetration strategies, and market development metrics. It is also an essential element for a correct product positioning strategy.

In conclusion, Market Intelligence impacts business growth as it increases the quality and speed of decision-making and promotes efficiency, organizational learning, and idea generation.

“Based on the methodology presented in “The Handbook of Market Intelligence” by Hans Hedin, Irmeli Hirvensalo and Markko Vaarnas”

See more on Sales & Marketing

Find out more about improving this business area