The company

The concerned company is specialized in the packaging of fruit products. It belongs to a wider group that also owns the upstream business of producing fruit concentrate and pulp. The company is distinguished by its unique recipes and packaging, which grant the products a premium quality and reputation.

The challenge

The entity generates around £30m per year with a gross margin of 29%, significantly below the average for the sector.

Following a strategic review program, an EBITDA increase target of £1m was set as a vector for increasing profitability both through growth and by reducing costs with raw materials and components.

The main problems identified in the sourcing area were: dependence on single suppliers, inefficient and non-standardized negotiation, uncontrolled service levels, purchases without contracts, high stocks and damaged material all leading to lost sales.

The approach

The approach to the problem followed a methodology structured in four phases, which included, firstly, the analysis of the data and the in-depth diagnosis of the initial situation, and secondly, the solutions design.

Spend Analysis

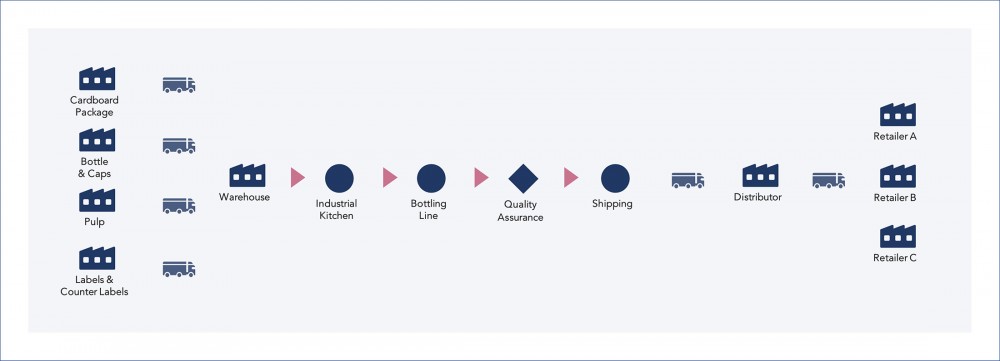

The final product is composed of three types of elements: raw materials, subsidiary materials and packaging materials. The formula itself consists of raw materials (fruit pulp) and subsidiary materials (water, preservatives, lemon, sugar and food coloring). Packaging materials comprise primary elements (glass bottles, cap and labels) and secondary elements (cartons, pallets and wrapping film).

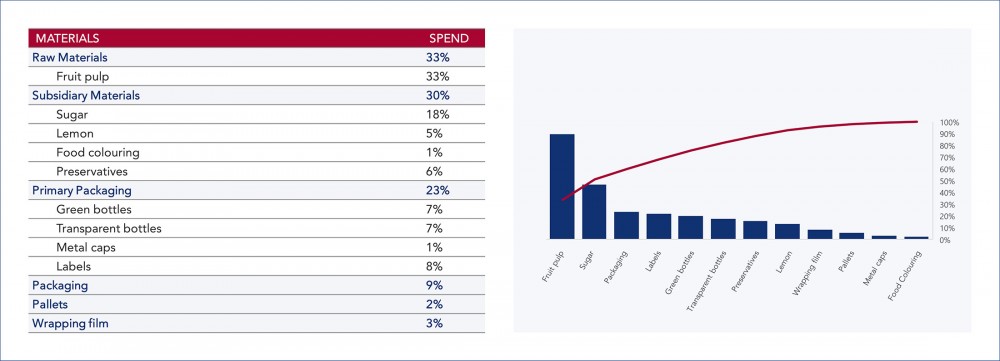

Taking this into account, total costs were grouped into twelve purchase categories and the corresponding analysis was carried out using a Pareto chart, which concluded that the two highest value families make up 50% of the total. The last four references of the bar chart on the right make up only 7% and the remaining 43% are evenly distributed across six categories.

Spend analysis

Supply Risk Analysis

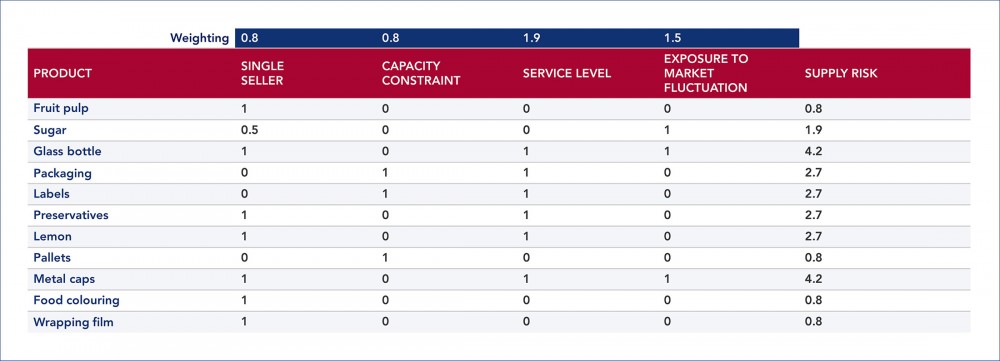

A detailed approach to the sourcing system implies not only having visibility over the breakdown of expenses, but also considering the degree of risk to which each purchase category is subject.

To this end, it was considered that risk results from the combined effect of four variables: number of supply alternatives, supplier capacity constraints, level of service provided and exposure to market fluctuations. Each variable was assigned a weight based on its impact.

Supply risk analysis

Category Prioritization

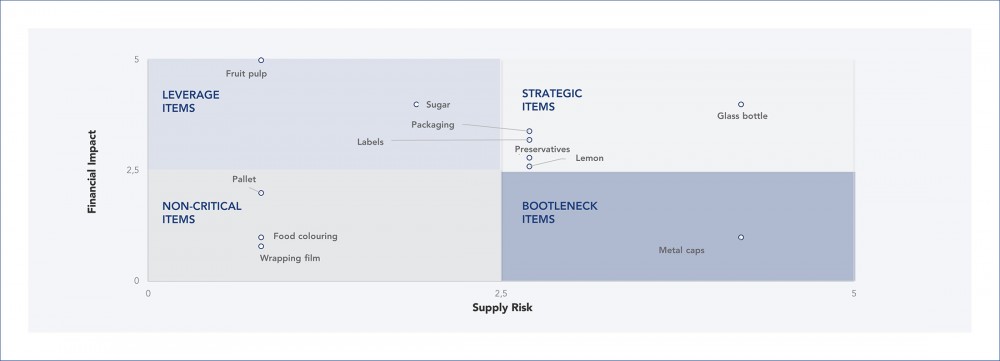

The combination of the previous analyses made it possible to create a priority matrix, where the vertical axis shows the impact on the business (proportional to the total amount of the purchase) and, on the horizontal axis, the supply risk.

Prioritization matrix

Each quadrant has a classification that determines the degree of the action priority. Strategic items should be addressed first, then leverage items, followed by bottleneck items and, finally, non-critical items. Given the reduced number of categories and for scaling reasons, it was decided to select all product families except for the three cases in which risk and impact are both low, as it was considered that the effort would not offset the eventual return.

Solutions Design

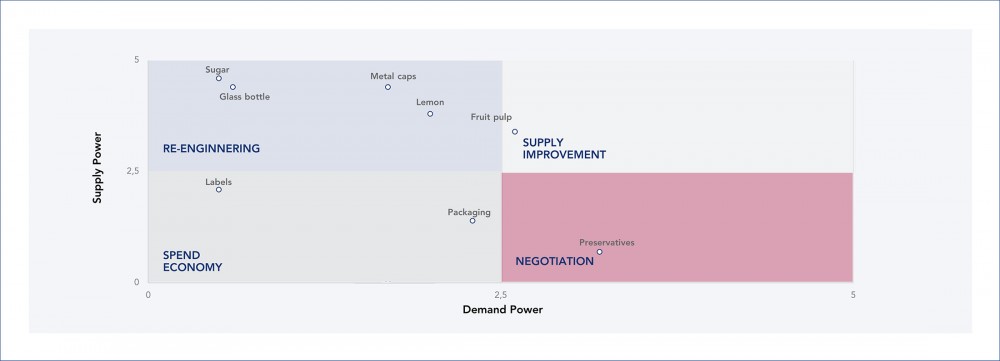

The solutions were designed using the Sourcing Matrix, a tool that allows differentiated strategies to be outlined for each article, according to the relative positioning between the power of demand and the power of supply.

Thus, the categories were positioned in the Matrix according to the selection defined in the previous step and based on relevant variables such as the size of the business, the degree of differentiation of the portfolio, competitiveness, market share and stage of maturity. The axes obey an a-dimensional scale, from 0 (low power) to 5 (high power).

Sourcing matrix

To confer basic stability to the whole system, transversal initiatives were defined, including the recalculation of all supply parameters, the definition of a ranking of suppliers per article and respective allocation rules, the review and renegotiation of contracts and respective penalty clauses in case of non-compliance, and the creation of dashboards for monitoring and timely action.

In the specific case of the label’s category, new competitive market alternatives were studied in order to reduce the gap between the power of supply and demand.

For cardboard boxes, where there was, for no apparent reason, a very wide range with high differentiation, the main action was the Variety Reduction Programme (VRP), which allowed orders to be grouped and economies of scale to be obtained from a single supplier.

Preservatives had a major problem of obsolescence, due to over-ordering minimum quantities and to short lifecycle time from the moment the lid was opened. Negotiation tactics were outlined to secure the right preservatives in the right amounts and moments, without jeopardising the purchase price. To ensure mutual benefits, an annual exclusivity contract was established, in which the supplier has instant visibility over consumption and commits to deliver smaller batches in a phased manner.

In the case of sugar and glass bottles, for which there was a high dependency and a high exposure to market fluctuations, the Value Analysis Value Engineering (VAVE) method was implemented, focusing on cost reduction. In the first case, the specific objective was to find economically viable substitutes for sugar, which did not impact on the characteristics of the final product. In the second case, working together with the supplier, the glass bottles were reconfigured to reduce their weight and, consequently, their cost.

For the lemon category, where the main problem was the high dependence on a single source, the company took advantage of the fact that this is a regional product to study proximity alternatives through a tendering process to lower risks and costs at the same time.

Metal caps were a major concern because they compromised the efficiency of the production process with defects and successive stoppages of the factory bottleneck. Here, a Linear Price Performance (LPP) workshop was carried out, concluding that an additional investment in higher cost references would be compensated by a benefit in terms of the operational performance of the caps on the line.

Finally, for the fruit pulp, the main disruptive decision was to launch quality improvement workshops in collaboration with the supplier. The fact that this raw material is supplied by a company from the same group facilitated the integration of processes and systems in a win-win partnership.

Results

Through the set of actions outlined within the scope of the project, an increase in EBITDA in the order of £1.6m was estimated.

The gains were split into two main branches. On the one hand, the recovery of lost sales by optimizing stock management and minimizing stock-outs and by increasing efficiency and output. On the other hand, the global reduction of costs through economies of scale, the review and standardization of contracts, improved negotiation, re-engineering, and partnership strategies established.

#process manufacturing #sourcing

See more on Process Manufacturing

Find out more about transformation in this sector

See more on Sourcing & Suppliers

Find out more about improving this business area